The first two parts (Part One, Part Two) of this series talked about the essentials of how to budget. This third part is for those of you who are having a difficult time making the ends meet to get your needs met.

The first two parts (Part One, Part Two) of this series talked about the essentials of how to budget. This third part is for those of you who are having a difficult time making the ends meet to get your needs met.

I’m talking about when cutting cable and going cash only for groceries isn’t enough. When you need help. When there isn’t much (or anything) to eat. When the power might be shut off. When there isn’t money to put gas in your car to get to work or job interviews.

This is the most important thing to remember: It is ok to ask for help. It is ok to seek out services and take advantage of programs. Do not worry about what others will think- This pandemic and all of the fallout that has happened has affected so many of us. So many hardworking families and individuals need a hand up right now.

A lot of the services and programs listed below are specifically for San Diego County. If you live outside San Diego County, I recommend that you call 211 anywhere in the US. They can help you find resources- all judgment free!

So when I talk about needs being met, I mean:

- Shelter (Rent/mortgage assistance/utilities)

- Food (Healthy food for you/your family and pets)

- Comfort (Clothing, healthcare, medication)

Shelter:

- If you have a mortgage, contact your lender for a forbearance. You may have to provide them with proof that you are unable to pay.

- If you are a renter in San Diego, here is the County Rental Assistance site.

- If you require assistance with your utilities, SDG&E has many programs and assistance available.

- For your water/sewer bills, you will need to contact them directly. There are so many water municipalities in San Diego County.

Food: Food insecurity is a cause near and dear to my heart, so I have all kinds of resources to share!

Food: Food insecurity is a cause near and dear to my heart, so I have all kinds of resources to share!

- North County Food Resources

- The Rest of the County Food Resources

- San Diego County Neighborhood Produce Distributions (This is free and all locations are drive thru/contactless. You pop your trunk, queue up, and you are given fresh produce and other essentials and you are on your way!)

- Porchlight Community Services often has free food baskets available for those in need.

- Faith Chapel in Spring Valley is doing Free Food Distributions every Friday through the end of the year.

- If you have kids 2-18, check with your local school district to learn more about free lunch distributions through the end of this year. This is subsidized by the USDA, and many school districts are providing breakfast and lunch for all kids 2-18.

- Many communities have blessing boxes/free little pantries where you can access free food 24/7

- Feeding America and 211 have additional resources

Many food banks give out pet food as well- don’t forget to mention your furry friends when you complete your intake paperwork (which is oftentimes to find out demographic information to obtain additional funding from the government or private grants). Some do not require any paperwork at all.

Comfort: Being housed and fed is important, in addition to this I’ve added the comfort category. This includes clean, well fitting clothes, access to health care, and prescription medicines.

Comfort: Being housed and fed is important, in addition to this I’ve added the comfort category. This includes clean, well fitting clothes, access to health care, and prescription medicines.

- There are many resources for no and low cost clothing (besides thrift stores, which have become increasingly higher in cost in the past year). Naomi’s Closet, Closet on 54th, Charity’s Closet at Sonrise Church, Sharia’s Closet are all San Diego resources. I’ve been told that some Salvation Army churches offer free clothing vouchers to be redeemed at their thrift shops. Don’t forget your local Buy Nothing Group too! So many of your local neighbors are cleaning out their clothes and purging while they are stuck at home, you’d be surprised what your neighbors are will to share with you.

- If you are in need of healthcare, there are several options. Medicaid/Medi-cal may be available for some. If you have had a “life event” (job separation, birth of a child, death of a spouse, marriage, etc.) you can look for health insurance in your state’s Health Insurance Exchange. Here is a link to California’s Exchange. There are frequently lower rates or discounts for those with certain income limits.

- If you or family members take prescription medicines, look into discount programs like Singlecare (which you can access via the Fetch Rewards App and earn cashback/points), or GoodRX. Some pharmacies have their own discount programs too. Make sure to ask the pharmacy staff. Another option is to ask your doctor for medication samples when you are visiting them. Many doctors have medication samples in their offices, and most doctors are willing to help you when you tell them you need assistance with medication costs.

In our last post, I talked about the basics of starting a budget (you can read it h

In our last post, I talked about the basics of starting a budget (you can read it h I’ve written about budgeting before, but now more than ever so many of us need to set up a budget that works. One that is easy to stick to. There are so many ways of doing a budget, so many styles- cash envelopes, bucket/different accounts, multiple debit cards for various budget items… It can be tricky. I’m going to be breaking down the household budget, and how it can be done, how to shave money off your household expenses, and save money without suffering or feeling like you are doomed to a life of instant ramen and tap water.

I’ve written about budgeting before, but now more than ever so many of us need to set up a budget that works. One that is easy to stick to. There are so many ways of doing a budget, so many styles- cash envelopes, bucket/different accounts, multiple debit cards for various budget items… It can be tricky. I’m going to be breaking down the household budget, and how it can be done, how to shave money off your household expenses, and save money without suffering or feeling like you are doomed to a life of instant ramen and tap water.

The Climate Credit that we’ve all grown accustomed to seeing on our April and October bills has been moved to August and September when most Californians have higher utility bills due to the weather.

The Climate Credit that we’ve all grown accustomed to seeing on our April and October bills has been moved to August and September when most Californians have higher utility bills due to the weather. The Climate Credit that we’ve all grown accustomed to seeing on our April and October bills has been moved to August and September when most Californians have higher utility bills due to the weather.

The Climate Credit that we’ve all grown accustomed to seeing on our April and October bills has been moved to August and September when most Californians have higher utility bills due to the weather. Previously we talked about shopping your Cell Phone service, Internet service, even your Auto/Home/Health insurance.

Previously we talked about shopping your Cell Phone service, Internet service, even your Auto/Home/Health insurance. WOO HOO!! It’s back! The second California Climate Credit is back for it’s second installment of the year!

WOO HOO!! It’s back! The second California Climate Credit is back for it’s second installment of the year!

Imagine my joy when I opened my email this morning and I found out I have $44.85 SDG&E bill!

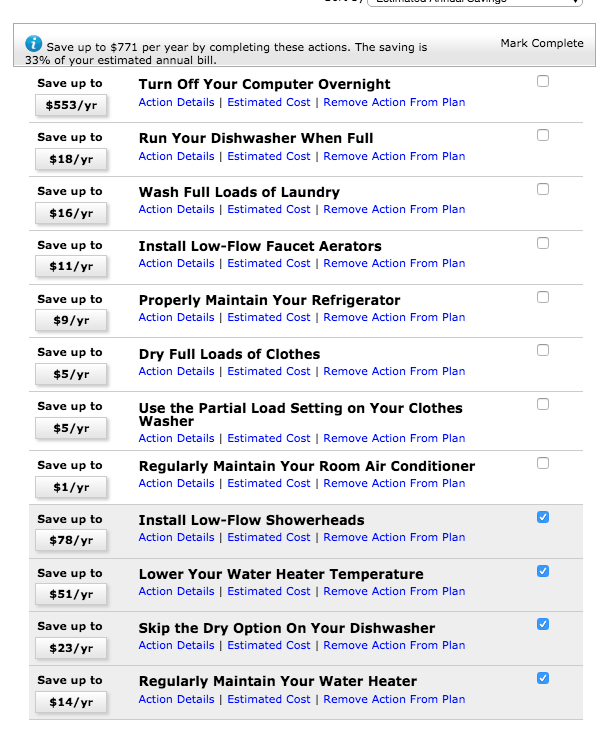

Imagine my joy when I opened my email this morning and I found out I have $44.85 SDG&E bill! Looking for more ways to saving money on your power bill without doing crazy stuff like turning off your water heater when you aren’t home and unplugging everything (including your fridge) during the day? Ok, so I’ve been watching episodes of Extreme Cheapskates on Netflix (and it’s scary what people will do to save a few bucks), but I did find out about a great legit program that can help San Diego, CA area residents!

Looking for more ways to saving money on your power bill without doing crazy stuff like turning off your water heater when you aren’t home and unplugging everything (including your fridge) during the day? Ok, so I’ve been watching episodes of Extreme Cheapskates on Netflix (and it’s scary what people will do to save a few bucks), but I did find out about a great legit program that can help San Diego, CA area residents!