Soo, the potato is crazy in the photo, but it made me laugh, so I included it.

As I mentioned in this post, we’ve got 7 posts coming through the end of the year to help you start 2022 off on a good foot.

I’ve talked a lot about budgeting before and not much has changed except that the cost of stuff keeps going up. Inflation is a bitch, y’all. And with wages not keeping up with the inflation, we’ve got to do what we can. We need to control the factors that we have to ability to control.

Setting up a budget takes time. You can do it all at once, but be prepared to spend a few hours working on it.

You’ll need:

Access to your bank account or bank statements for three months.

A Google Sheet page, or an Excel Spreadsheet

List of your monthly financial obligations. Here are just a few of those:

- Mortgage/Rent (Our Mortgage payment includes impounds for our Homeowners insurance and property taxes)

- Gas/Electric*

- Gift Fund

- Transfer to Savings

- Life Insurance

- Auto Insurance

- Hulu

- Car payment

- Kids 529

- Netflix

- YMCA

- Internet

- Credit Card Balances

- Student Loan Payments

- Water Bill*

- Groceries*

- Fun Money (stuff to do with kiddos/girls nights in/date nights)*

- Gasoline*

Of all of these categories, the only ones that have any difference per month are the ones I indicated with an asterisk (*). For Gas/Electric and the water bill, I averaged the cost over three months and used that amount for the budget.

The categories I included above are what is in my budget, you may have other items that my family does not. Some of the expenses such as Health Insurance and retirement savings come out of paychecks, so for our family, they are not included in our budget. You may wish to add them to your budget if you pay them directly.

Cash for some Budget Line Items: For items such as groceries, fun money, and gasoline I visit the ATM each week and take out cash. I paperclip the money for each budget line item together and keep them separate in my wallet. When the money is gone, no more spending.

Doing cash for those line items really helps me take a hard look at shopping for groceries (this is when cash back apps, couponing, and price per unit knowledge all come in handy), and making sure that I am getting the best deal on gas (I have the GasBuddy app, it’s very useful). Any unspent money gets rolled over to the next week.

If you are discovering that you have too many bills and not enough money (and hey, it happens), trim where you can ( this article has some helpful suggestions), and if that’s still not enough, here are some Southern CA/San Diego based resources to help you.

Please do not be embarrassed to seek help. Resources are available to help you. If in the future you are able to give back, please do, but in the meantime, accept the help that is offered.

Next up, we’ll be talking about ways to save money on groceries and beyond. The beyond is going to be how to get toothpaste and health and beauty items for free (or really cheap) without turning into the stereotypical crazy coupon lady. Because clipping coupons out of ten plus newspapers each week is sooooo 2008. Seriously. I love to save money, but I don’t clip Sunday papers these days.

I’ve written about budgeting before, but now more than ever so many of us need to set up a budget that works. One that is easy to stick to. There are so many ways of doing a budget, so many styles- cash envelopes, bucket/different accounts, multiple debit cards for various budget items… It can be tricky. I’m going to be breaking down the household budget, and how it can be done, how to shave money off your household expenses, and save money without suffering or feeling like you are doomed to a life of instant ramen and tap water.

I’ve written about budgeting before, but now more than ever so many of us need to set up a budget that works. One that is easy to stick to. There are so many ways of doing a budget, so many styles- cash envelopes, bucket/different accounts, multiple debit cards for various budget items… It can be tricky. I’m going to be breaking down the household budget, and how it can be done, how to shave money off your household expenses, and save money without suffering or feeling like you are doomed to a life of instant ramen and tap water.

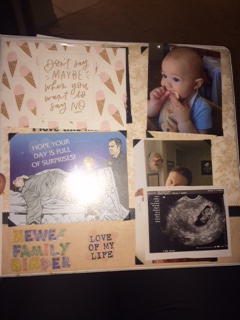

So, how to store all the important stuff… I’m bringing back The Family Binder. It’s a 3 inch binder, with

So, how to store all the important stuff… I’m bringing back The Family Binder. It’s a 3 inch binder, with  I use some of the pages from the

I use some of the pages from the

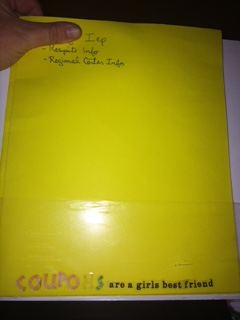

I have a folder tucked in the front pocket of the binder for the big kids educational/medical stuff like his most recent IEP, Regional Center correspondence, and copies of his medical diagnostic paperwork.

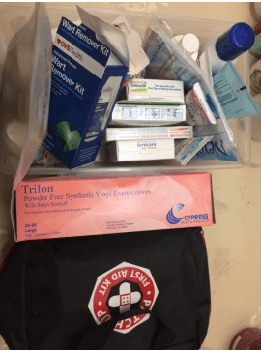

I have a folder tucked in the front pocket of the binder for the big kids educational/medical stuff like his most recent IEP, Regional Center correspondence, and copies of his medical diagnostic paperwork. When you have kids or are accident prone (like I am), a comprehensive first aid kit is a must. After so many years and iterations, this is the first aid kit that works best for our family.

When you have kids or are accident prone (like I am), a comprehensive first aid kit is a must. After so many years and iterations, this is the first aid kit that works best for our family.